BankAid: March 2023 Market Flash

.png?width=352&name=MicrosoftTeams-image%20(30).png)

2022 was tough for investors given the historically bad year in bonds and significant drawdown in stocks. We expected a calmer year for markets entering 2023 and the year was off to a good start. The S&P 500 was up 3.7% and the Bloomberg Aggregate Bond Index was up 0.7% through February (Source: Bloomberg Finance, LP), but unfortunately, this was the calm before the storm.

What Happened?

News broke on Wednesday, March 8th that Silicon Valley Bank (SVB) was going to raise $1.5 billion to stem losses from the forced liquidation of bond holdings necessary to meet significant client withdrawals. This unexpected news caught many off guard and thus sparked a classic bank run with many SVB customers trying to rapidly withdraw and transfer their money away from the bank. The FDIC took control of Silicon Valley Bank on Friday, March 10, and announced by the market opening on Monday, March 13, that they’d guarantee all uninsured deposits at Silicon Valley Bank and Signature Bank (which was also seized by the FDIC over the weekend). Stock and bondholders at both banks are seemingly wiped out while deposits have been guaranteed by the government. Now there are concerns and fears surrounding other banks, especially small and regional banks.

Asset Implications

As fiduciaries, Curi Capital’s primary responsibility is to always put our clients first. As such, our priority in the wake of SVB was to ensure our clients’ assets were safe. We reached out to our custodians, contacted all our private investment managers (who were the most likely to have SVB exposure), and spoke to numerous banking experts, including a member of the Dodd-Frank implementation team. The exercise proved reassuring, as we can report we did not find any client assets that were directly impacted by the SVB and Signature Bank crisis.

A few things to keep in mind:

- Investment accounts at custodians, such as Schwab and Fidelity, are segregated assets held in individual client names that could easily be separated should it become necessary.

- Investment accounts are covered by SIPC up to $500k (cash is limited to $250k of the $500k).

- The government just stepped in and backstopped all uninsured deposits at SVB and Signature Bank, demonstrating its commitment to making sure ordinary citizens are not negatively affected.

Our Current View

While predictions are never easy, they’re particularly difficult during a storm. Nevertheless, here’s our current view:

- The government fully backing uninsured deposits was necessary and should minimize the risk of additional bank runs.

- There may be more banks that are taken over by the government or acquired by larger banks so expect volatility to continue. We would expect uninsured deposits will continue to be guaranteed by the U.S. government as needed.

- The interest rate picture has changed, at least in the short term. The market is now pricing in interest rate cuts starting in July following today’s 25bps rate hike by the U.S. Federal Reserve. (Source: World Interest Rate Probability (WIRP), Bloomberg Finances, LP as of March 22, 2023.)

What to Expect

Expectations for interest rate cuts may imply the market expects a recession sooner than it did several weeks ago. As we messaged in our Market Outlook in January, we expected the market would switch from inflation fears to recession fears. SVB and the fallout from SVB might speed up that timeline, and inflation is now less of a concern. The likely fallout from recent events is that banks will lend less as they shore up their balance sheets. Credit, liquidity, and financial conditions will get tighter. This will likely slow the economy and may lead to a recession later this year. The current banking crisis is a clear negative for the economy in the short run.

The impact on stock and bond markets, however, is not as clear. The economy slowing could hurt corporate earnings, which is generally bad for stocks. The Fed no longer raising rates could prevent treasury rates from moving higher, especially shorter maturities, which would be good for bonds— particularly treasury bond holders.

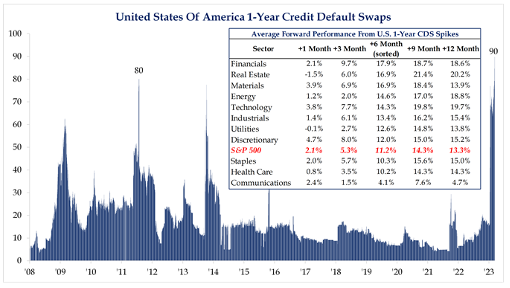

The Fed’s balance sheet is expanding once again, and they may have to stop quantitative tightening. If recent history repeats, the Fed Balance sheet expansion is typically a boost to financial assets including stocks. Also, credit default swaps (CDS)—insurance that protects against bond defaults—have moved significantly higher. A spike in CDS prices means the market is extremely concerned about defaults and paying a lot more for insurance than usual. This has been a contrarian signal in the past as it’s a sign of capitulation. As the chart and table below indicate, the S&P 500 has moved higher following previous CDS spikes.

Source: Grabinski, Ryan. “Dollar Fades On Lower Rate Hike Expectations.” Strategas. March 14, 2023.

What Can I Do?

Given these expectations, investors should take time to review their investment portfolio and determine if adjustments are needed based on changing market conditions. Assessing if changes are needed to your long-term plan and portfolio is critical to achieving your financial objectives.

If you have upcoming spending needs and your liquidity bucket is low, it may be a great time to take advantage of short-term bond yields. If you have too much cash and have been waiting for the next market crash, now may be a good time to explore long-term investment opportunities with favorable risk-reward characteristics independent of market timing.

As always, if you are interested in reviewing your portfolio, discussing potential actions, or exploring what Curi Capital can do for you, please reach out to a member of our team at 984-202-2800.

Please note: This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Curi Capital is a registered investment advisor. Registration does not imply a certain level of skill or training. More information about Curi Capital can be found in its Form ADV Part 2, which is available upon request.

Past performance is not a guarantee of future results. All investment strategies involve risk and have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client's investment portfolio. References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and indexes do not reflect the deduction of the advisor's fees or other trading expenses.

Curi Capital clients should contact the Company if there have been changes in the client's financial situation or investment objectives, or if the client wishes to impose any reasonable restrictions on the management of the client's account or reasonably modify existing restrictions.

About the Author

Comments