When Budgets Need to Budge

Frances Cronlund explores the importance of setting a budget - even when the process is uncomfortable.

My son is a rising first-year high schooler with a goal of making the school’s soccer team. His summer training plan includes cycling, running sprint intervals, weightlifting, ice baths and two sleepaway (read: expensive) soccer camps. He’s fueling with high volume, high quality (read: expensive) nutrition. Our family’s usual spending plan (read: already expensive) needs to budge for our active teenage son, who now requests a “second dinner.” I welcome all of this, of course, even after he just passed me in height.

Every life transition, major or minor, is an excellent time to review spending history and use that information to forecast needs. When I work with couples planning for retirement, the biggest hurdle is analyzing their realistic spending needs, wants and aspirations. The best predictor of future spending needs is recent history. That means looking backwards, without judgement, to see what the spending pattern has been. But how can you get started?

- Awareness is key. We cannot change what we cannot name. If you’re like most people who do not monitor their spending patterns closely, you may be asking yourself “where did all of my money go?” The first step, before changing anything, is to know where you are. Take time to look back at the last 1, 3, 6, 9 or 12 months, for example, and notice your actual inflows and outflows.

- What if I don’t want to know? If this task seems daunting, pretend you are looking at someone else’s spending history to take the edge off. That way it’s more like an anthropological research study, not a judgmental self-reflection. Several times in my practice, I have listened to couples on the edge of retirement say, “This is the first time we’ve had to make a budget.” There is no gift like the present and it’s never too late to give it a shot.

- Don’t be intuitive, be real. Using intuition can be an avoidance tactic if you don’t really want to know your spending patterns. While our emotions and patterns about money are in the psychology department, our actual spending history is in the math department. So don’t “feel like” you know where your money is going. Instead, use a calculator and add it up.

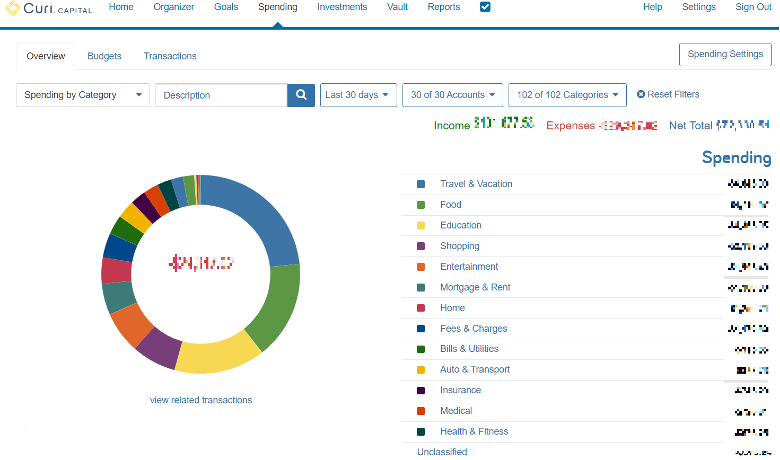

- Make a plan that works for you. I like the Curi Capital tool (see graphic below) to review our family’s transactions almost every Saturday morning. The simple act of tracking outflows weekly is an invaluable tool. It allows us to recognize where our money is going in real time, which can build a self-awareness, accountability, and natural self-correction. That said, I’ve never met anyone who was eager to monitor their spending history. This might explain why my family sometimes sleeps in on Saturdays.

- Keep it simple. In addition to a bottom-up approach, also try a top down approach. Look at your last income tax forms to assess how much money you earned. Subtract federal, state, and payroll taxes paid along with any amount that went into your benefits, retirement, or personal savings accounts. Then you’re left with your baseline spending for one year.

- Mission Critical. If you need to restrict your spending, you may find that using your checking account’s debit card is easier than credit cards for purchases. While the various rewards and purchase protections offered by credit card companies may be enticing, it can be difficult to alter spending patterns when regularly using a credit card in place of a debit card. The ability to watch numbers fall in an account as you spend, rather than rise as your incur debt, can help create a more accurate frame of reference when addressing spending habits.

While it may be unsettling for some, you can use your spending history to understand how to build a mindful and sustainable plan going forward. A financial advisor functions as an accountability partner while also helping you build a financial plan. So whether your budgets need to budge for soccer camps and protein powder, you’ve just merged your finances with a spouse, you’re heading into retirement, or you simply want to take control of your spending habits−it all starts with healthy budget-setting.

Disclosure: Curi Wealth Management, LLC, dba Curi Capital, is an investment adviser in Raleigh, North Carolina. Curi Capital is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the SEC. Curi Capital only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Curi Capital’s current written disclosure brochures, filed with the SEC, which discuss, among other things, Curi Capital’s business practices, services and fees, are available through the SEC’s website at: www.adviserinfo.sec.gov.

About the Author

Frances is a Chicago native with roots in Northern Ohio and East Tennessee. She earned her BA from Salem College in Business Administration with an Economics specialization. Frances furthered her education at Campbell University, The College of Financial Planning and The Wharton School’s Institute for Executive Education.

Frances is also a financial planning guest lecturer at her alma mater, Salem College, which just celebrated their 250th anniversary. To commemorate the anniversary, Frances and four other alumnae recreated their founders’ journey by walking 500 miles from Bethlehem, PA to Winston-Salem, NC, on foot. PBS created a documentary, “Journey to Salem,” about their adventure which was released in March 2023. Outside of the office, Frances and her husband, Matt, love traveling with their children, Katrin and Henry.

Now in her 26th year in wealth management, she is driven by a desire to prepare families through financial education.

Registered Rep

Investment Advisory Services are offered through Curi RMB Capital. Securities are offered through Lion Street Financial, LLC. (LSF), member FINRA & SIPC. LSF is not an affiliated company.

Comments