Surprise!: Q3 2023 Market Commentary

Mark Paccione explores market changes from the first half of 2023, and offers his opinion on predictions moving forward.

It’s safe to say that this year’s consensus market outlook was relatively bleak. As explained in a recent article published to Bloomberg, “Heading into the year, a handful of predictions dominated strategists’ annual outlooks. A global recession was imminent. Bonds would trounce stocks as equities retested bear-market lows. Central banks would soon be able to stop the aggressive rate hikes that made 2022 such a year of market misery. As growth stumbled, there would be more pain for risky assets.”[1] Thankfully, markets did not listen to the dire predictions. The MSCI All Country World Index was up 13.9%, and the Bloomberg U.S. Aggregate Bond Index was up 2.1% for the first six months of 2023.2 Markets were up despite the U.S. Federal Reserve continuing to hike interest rates, several bank failures (Silicon Valley, First Republic, and Credit Suisse), and continued calls for an oncoming recession that’s yet to arrive.

With that said, many bears remain undeterred, pointing to:

- Lofty equity valuations

- Continued Fed tightening

- Dwindling consumer savings

- Diminished bank lending

- Resumption of student loan payments

All of the items above serve as reasons bears think that a recession is on the horizon and markets are in for tough sledding during the back half of the year. On the flip side, bulls point to a rebound in housing, a Fed that is almost done raising interest rates, a strong consumer supported by a tight labor market, and artificial intelligence (AI) as the next great productivity driver as reasons for the market rally to continue

The Bright Side

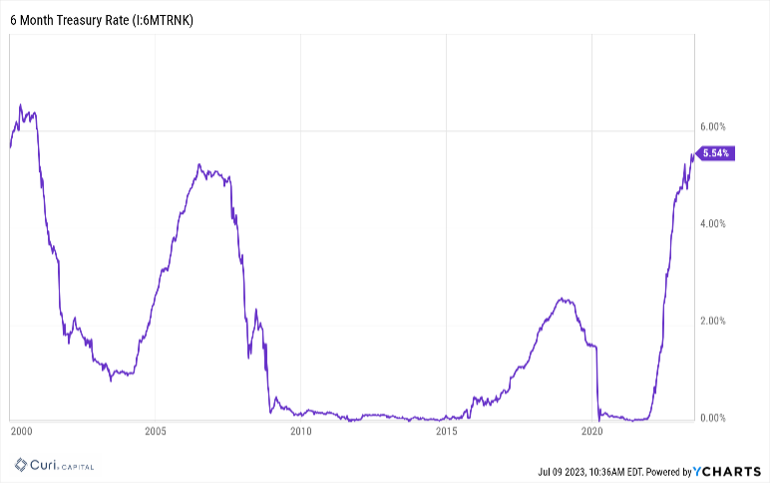

Fortunately, for Curi Capital clients invested in diversified portfolios, success is not dependent on the Investment Team’s ability to predict the near-term future. We are investors—not traders trying to time the market. It’s been proven repeatedly that markets are unpredictable, especially in the short term, and no one knows if the next 10% move in the market will be up or down. Rather than playing a losing game, we prefer to construct a diversified portfolio of investments that should perform well in the long term, taking advantage of market opportunities as they appear. Short-term U.S. Treasuries are one example of a current market opportunity. The 6-month Treasury Rate is over 5%, its highest level since 2000.

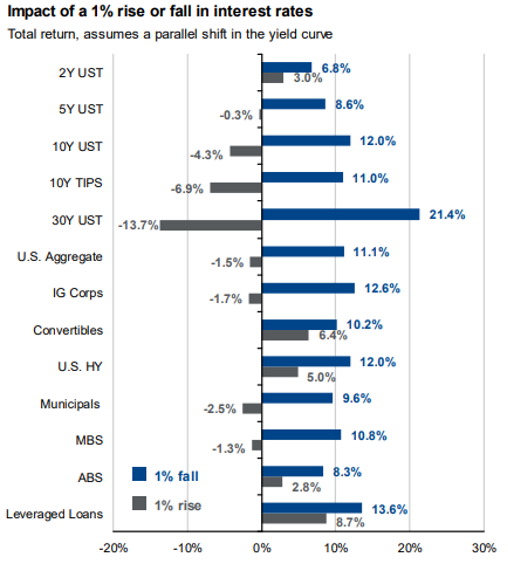

Short-term treasuries have essentially no credit risk and little to no interest rate risk, meaning they will likely deliver positive returns regardless of whether rates rise or fall, as indicated in the graph below from J.P. Morgan:

Source: J.P.Morgan. “Guide to the Markets.” June 30, 2023

The graph also illustrates that there are opportunities to harvest significant yields in other fixed income sectors. Curi Capital believes real estate debt and non-traditional lending are two areas of opportunity that fall into this category.

The Bottom Line

Many investors would be smart to take advantage of the recent rally to ensure they’re in the proper allocation and prepared for the next sell-off (whenever it comes around). An alarming article by the Wall Street Journal indicated that, “Nearly half of Vanguard 401(k) investors actively managing their money over the age of 55, held more than 70% of their portfolios in stocks.” [3]

It’s certainly possible that a 70% equity weighting to stocks is appropriate for someone over the age of 55, especially if the portfolio won’t support living expenses anytime soon or is destined for future generations. However, in all likelihood, there are too many retirees with too much exposure to stocks, making now a great time to rebalance to less risky asset classes.

While the market outlook may remain uncertain, it’s essential to remember that successful investing is not about predicting short-term market movements. By constructing a diversified portfolio and remaining adaptable to market opportunities, you can navigate the volatility and position yourself for long-term success. Remember, patience and long-term perspective are both key when it comes to investing in today's dynamic market environment. As always, if you are interested in reviewing your portfolio, discussing potential actions, or exploring what Curi Capital can do for you, please reach out to a member of our team at 984-202-2800.

Please note: This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Curi Wealth Management, LLC, dba Curi Capital is a registered investment advisor. Registration does not imply a certain level of skill or training. More information about Curi Capital can be found in its Form ADV Part 2, which is available upon request.

Past performance is not a guarantee of future results. All investment strategies involve risk and have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client's investment portfolio. References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and indexes do not reflect the deduction of the advisor's fees or other trading expenses.

Curi Capital clients should contact the Company if there have been changes in the client's financial situation or investment objectives, or if the client wishes to impose any reasonable restrictions on the management of the client's account or reasonably modify existing restrictions.

About the Author

.png?width=352&name=MicrosoftTeams-image%20(30).png)

Comments