Happy New Year!: Q1 2024 Market Commentary

Mark Paccione explores the action items you can take to best prepare your investment portfolio for current trends in the market as he breaks down what’s to come in the year ahead.

Every Sunday my family watches CBS Sunday Morning, or as my fifteen-year-old daughter calls it, “CBS Sunday BORING.” The show may be boring to some, but it is one of my favorites. It’s boring because it’s one of the few programs that doesn’t focus on bad news. Case in point, the show recently highlighted all the positive news in 2023, including: declining inflation, decreasing violent crime and property crime rates, falling carbon dioxide per capita, the first private railroad in over 100 years launched in Florida, and game-changing drugs to treat diabetes and obesity.

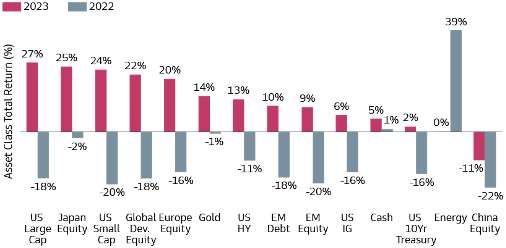

Compared to 2022, 2023 was a great year for the markets too, as this chart from Goldman Sachs highlights:

Source: Goldman Sachs. “2023 in Review.” January 2, 2023

What could go wrong?

Admittedly, it may be hard for markets to repeat the past year as there are storm clouds in the sky. Risks include:

- Recession

- Second wave of inflation

- Contested election

- Unexpected negative event(s)

While there are fewer economists predicting a recession than last year, there are still calls for recession. As of January 8, 2024, the Bloomberg U.S. Recession Probability forecast for the next twelve months was 50%.[1] One common argument for recession is the lagged impact of interest rate hikes. The Fed began hiking rates almost 24 months ago in March 2021; however, the last rate hike was July 2023. It can take an extended period before the full impact is felt.

Some worry that the Fed’s perceived dovish pivot in December may lead to a second wave of inflation. Inflation remains above the Fed’s stated target of 2%. The latest Core CPI measure for December, which calculates inflation excluding the more volatile food and energy components, shows year-over-year inflation of 3.9%. The fear is that the Fed is pausing too soon and therefore may begin cutting rates prematurely. Inflation may reignite given tight labor markets with an unemployment rate at the extremely low level of 3.7%.[2]

2024 is an election year and, as of this writing, President Biden and former President Trump are the two likely nominees. Regardless of who wins, there’s a significant probability that the election will be contested. The impact to the economy and market is tough to handicap and will depend largely on how long we don’t know who the next president is.

Finally, there’s usually at least one unexpected, market-moving event that no one foresees. The global pandemic in 2020 is one great example. However, there are unexpected events every year. In 2023, surprising events included Silicon Valley Bank’s bankruptcy, Hamas’s surprise attack on Israel, and the U.S. economy not falling into recession.

Reasons for optimism

While there are causes for concern, it’s important to remember the things that could go right in 2024, such as:

- No recession or hard landing

- Inflation and interest rates approaching more stable, long-term levels

- Market rally broadens out

- AI shows up in productivity measures

- No contested election

- An unforeseen event occurs but proves to be transitory

We believe there is a good chance the economy does not fall into a recession in 2024 and demonstrates the economy’s continued resilience and adaptability. This scenario suggests a 'muddle through' economy, where growth continues at a steady, albeit unspectacular pace, navigating through existing challenges without major downturns.

Inflation and interest rates might stabilize at sustainable long-term levels in 2024, indicating effective monetary policy measures. This stabilization could bring more predictability to the economy, aiding both consumers and businesses in planning and investment decisions.

The strong 2023 performance in the S&P 500 and the NASDAQ indices were largely driven by a handful of stocks often referred to as the 'Magnificent 7.' However, we did see the market rally broaden in Q4 with the Russell 2000 Index (U.S. Small Caps) and the MSCI Emerging Market Index outperforming the S&P 500. We would not be surprised to see other parts of the market play relative catch-up to large cap tech. For example, the financials heavy small cap space may benefit from interest rates that are significantly lower than 2023 peak levels, and from an interest rate curve that should normalize as the Federal Reserve begins to lower the short-term Fed Funds rate.

Artificial Intelligence could significantly contribute to productivity metrics in 2024, showcasing its increasing integration and impact in various industries and business processes. While awareness of artificial intelligence exploded over the past year or so with the growing popularity of Chat GPT, we are still early in the AI adoption cycle. Corporations and the public have not yet widely adopted nor implemented artificial intelligence. Consider how long it took for EVERYONE to be on the internet or for EVERYONE to have a cell phone or for EVERYONE to have a smartphone. As more user-friendly AI applications are developed, the adoption of AI will continue to grow, having the potential to make us more productive which is one of two key ingredients for economic growth.

The 2024 presidential election in the United States could see Nikki Haley win, or there could be no major disputes nor controversies surrounding the election result should former President Trump or President Biden win. So long as the uncertainty post-election doesn’t last for an extended period of time, any impact to markets should be as short-lived as they were in 2020.

2024 may witness surprising events that capture global attention. However, most events that capture the publics’ fleeting attention usually don’t lead to immediate, long-lasting changes in the economy or financial markets. Instead, most events, unexpected or otherwise, tend to have more transient impacts. For example, it’s possible we’ll have a government shutdown. While lots of ink will be spilled over the impact of another shutdown, if it does happen, it will most likely come and go with no real impact, and the news cycle will move on to the next potential “disaster.”

Investment & Portfolio Recommendations

There are several actions investors can take given what occurred in 2023 and what is expected for 2024. First, investors should consider moving to longer dated bonds as Fed rate cuts approach. Earning more than 5% on cash-like instruments has been welcomed by many investors; however, a six-month Treasury bill only locks in an interest rate for six months. Investors would be wise to lock-in longer term rates should interest rates return to the levels we’ve seen over the past decade.

Another timely action to consider is to rebalance one’s portfolio to long-term targets. Many investors with diversified portfolios have seen their U.S. large cap growth allocation outpace the rest of their portfolio. Rebalancing away from large cap growth to small caps and mid caps, for example, would take advantage of any catch-up in performance from asset classes that have lagged.

It’s also a great time to make sure you are in a portfolio that matches your long-term goals and risk tolerance. Several clients considered selling stock positions in October 2022 after the market was down more than 25% from recent highs. The S&P 500 is now back to previous highs set in late 2021 and early 2022. One of the worst things an investor can do is sell stocks after the market has declined. If you were close to reducing stock exposure in the Fall of 2022, now is a great time to make sure you’re in a portfolio that better aligns with your risk appetite. We don’t know when the next market sell-off will be but we do know it will come. Investors should make sure they have a portfolio allocation they can stick too even during bear markets.

Finally, 2023 was not just a good year for markets. Curi Capital announced a transformative merger with RMB Capital that became official on January 1, 2024. We believe the merger is beneficial to all stakeholders including our clients and Curi clients, and feel excited for what the future holds,

Here's to hoping 2024 is even better than 2023.

As always, if you have any questions about your investment portfolio, want to see if you’re properly positioned for today’s current market environment, or are exploring what Curi RMB Capital can do for you, please reach out to a member of our team at 984-202-2800.

Please note: This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Curi RMB Capital, LLC is a registered investment advisor. Registration does not imply a certain level of skill or training. More information about Curi RMB Capital can be found in its Form ADV Part 2, which is available upon request.

The opinions and analyses expressed in this newsletter are based on Curi RMB Capital, LLC’s (“Curi RMB”) research and professional experience are expressed as of the date of our mailing of this newsletter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is it intended to speak to any future time periods. Curi RMB makes no warranty or representation, express or implied, nor does Curi RMB accept any liability, with respect to the information and data set forth herein, and Curi RMB specifically disclaims any duty to update any of the information and data contained in this newsletter. The information and data in this newsletter does not constitute legal, tax, accounting, investment or other professional advice. Returns are presented net of fees. An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes, or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account.

[1] Source: Bloomberg Finance, LP. January 8, 2024.

[2] Source: Bloomberg Finance, LP. January 14, 2024.

About the Author

.png?width=352&name=MicrosoftTeams-image%20(30).png)

Comments